"Understanding Conforming Loan Limit History: A Comprehensive Guide to Its Evolution and Impact on Homebuyers"

#### Conforming Loan Limit HistoryThe term **conforming loan limit history** refers to the changes and trends in the maximum loan amounts that can be backed……

#### Conforming Loan Limit History

The term **conforming loan limit history** refers to the changes and trends in the maximum loan amounts that can be backed by government-sponsored enterprises (GSEs) such as Fannie Mae and Freddie Mac. These limits are crucial for homebuyers and real estate investors as they determine the eligibility for conforming loans, which typically offer lower interest rates and better terms compared to non-conforming loans.

#### The Importance of Conforming Loan Limits

Conforming loan limits are adjusted annually by the Federal Housing Finance Agency (FHFA) based on changes in the housing market and median home prices. Understanding the **conforming loan limit history** is essential for potential homebuyers, as it provides insight into how these limits have evolved over time and how they can affect mortgage availability and affordability.

#### Historical Overview

The history of conforming loan limits dates back to the establishment of Fannie Mae in 1938 and Freddie Mac in 1970. Initially, these limits were relatively low, reflecting the housing market's conditions at the time. Over the decades, as home prices increased dramatically, the conforming loan limits were adjusted to accommodate the rising costs.

For instance, in 2006, the conforming loan limit reached a peak of $417,000 for single-family homes in most areas. However, during the housing crisis of 2008, the limits were temporarily increased to stimulate the housing market. The Housing and Economic Recovery Act of 2008 allowed for higher limits in high-cost areas, which significantly impacted borrowers in regions with elevated home prices.

#### Recent Changes and Trends

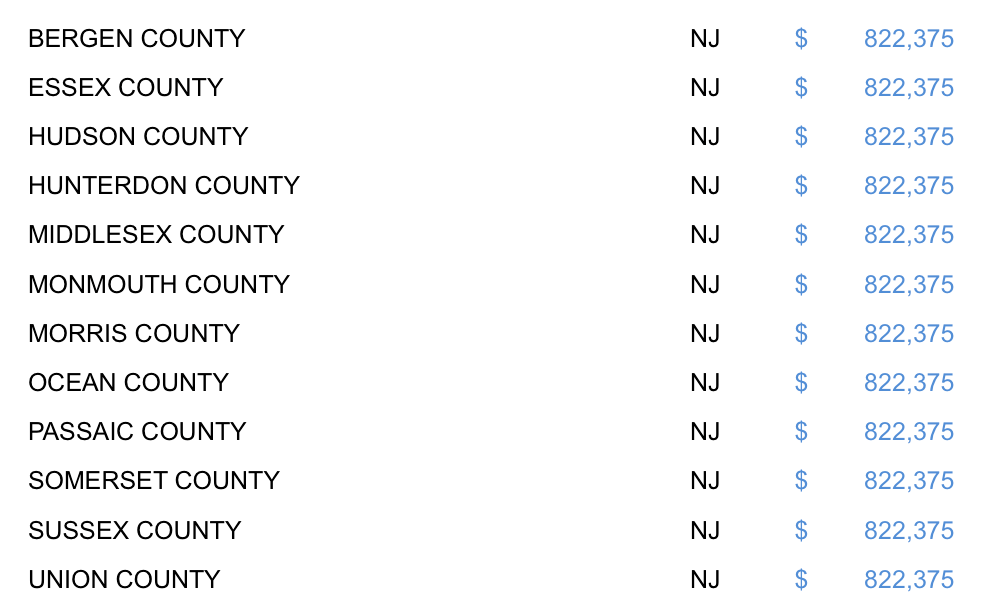

In recent years, the **conforming loan limit history** has shown a consistent upward trend, reflecting the recovery of the housing market and rising property values. For 2023, the baseline conforming loan limit for a single-family home is set at $726,200, with higher limits in designated high-cost areas. This increase is a response to the ongoing appreciation of home prices across the country.

#### Implications for Homebuyers

For homebuyers, understanding the **conforming loan limit history** is vital for several reasons:

1. **Loan Eligibility**: Knowing the current limits helps buyers determine whether they qualify for a conforming loan or if they need to seek alternative financing options.

2. **Interest Rates**: Conforming loans generally offer lower interest rates compared to non-conforming loans, making them more attractive for borrowers.

3. **Market Trends**: By analyzing the historical data of conforming loan limits, buyers can gain insights into market trends and make informed decisions about when to buy.

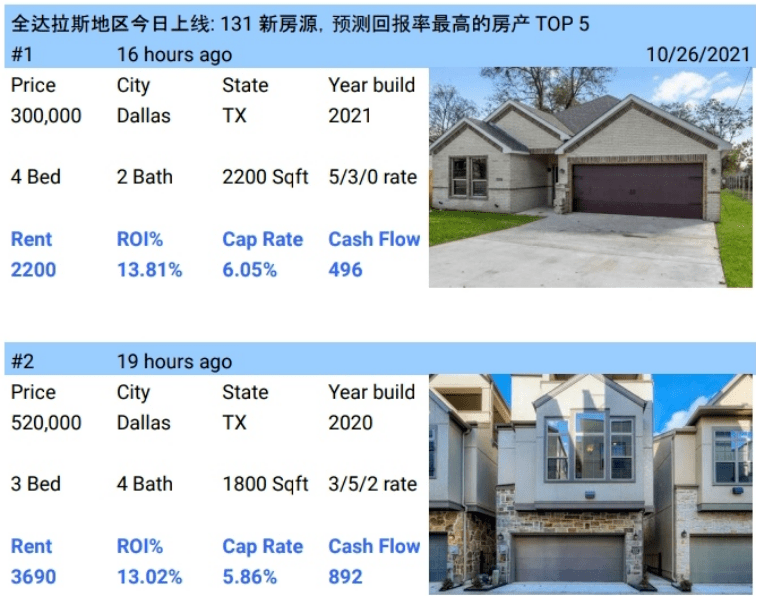

4. **Investment Opportunities**: Investors can also benefit from understanding these limits, as they directly impact the financing options available for rental properties and other real estate investments.

#### Conclusion

In summary, the **conforming loan limit history** is a critical aspect of the housing finance landscape. By tracking the changes in these limits, homebuyers and investors can better navigate the complexities of the mortgage market. As the housing market continues to evolve, staying informed about conforming loan limits will remain essential for anyone looking to purchase a home or invest in real estate. Understanding this history not only aids in financial planning but also empowers buyers to make strategic decisions in a competitive market.