How to Effectively Calculate Boat Loan Payments: A Comprehensive Guide

#### Calculate Boat LoanWhen considering the purchase of a boat, one of the most important steps is to calculate boat loan payments accurately. This process……

#### Calculate Boat Loan

When considering the purchase of a boat, one of the most important steps is to calculate boat loan payments accurately. This process involves understanding the total cost of the boat, the loan terms, interest rates, and your financial situation. By doing so, you can make informed decisions about your financing options and ensure that your monthly payments fit within your budget.

#### Understanding Boat Loans

Boat loans are a type of secured financing specifically designed for purchasing watercraft. Just like car loans, boat loans can come with varying interest rates, terms, and down payment requirements. Typically, lenders will evaluate your credit score, income, and debt-to-income ratio to determine your eligibility for a loan and the interest rate you will receive.

#### Factors to Consider When Calculating Boat Loans

1. **Purchase Price**: This is the initial cost of the boat. Make sure to include any additional fees such as taxes, registration, and insurance when calculating your total loan amount.

2. **Down Payment**: Most lenders require a down payment, which is usually a percentage of the purchase price. A larger down payment can lead to lower monthly payments and less interest paid over the life of the loan.

3. **Loan Term**: The term of the loan can significantly affect your monthly payments. Boat loans typically range from 5 to 20 years. A longer term may result in lower monthly payments but can lead to paying more interest over time.

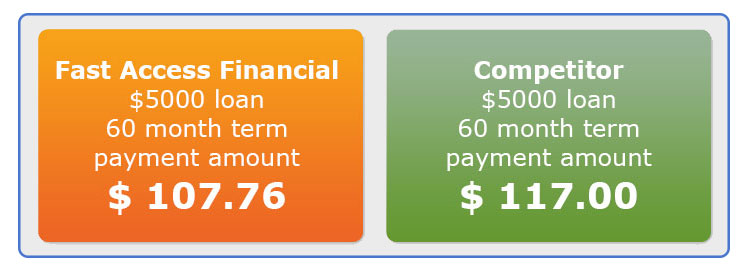

4. **Interest Rate**: The interest rate is the cost of borrowing money and can vary based on your credit score and the lender. A lower interest rate can save you a significant amount of money over the life of the loan.

5. **Monthly Payment Calculation**: To calculate boat loan payments, you can use a simple formula or an online loan calculator. The formula generally involves the principal amount, the interest rate, and the loan term.

#### Using a Loan Calculator

An online loan calculator can simplify the process of calculating boat loans. You can input your loan amount, interest rate, and loan term to get an estimate of your monthly payments. This tool allows you to experiment with different scenarios, such as varying the down payment or loan term, to see how it affects your payments.

#### Example Calculation

Let’s say you are looking to buy a boat priced at $30,000, with a down payment of $5,000, an interest rate of 5%, and a loan term of 10 years.

1. **Loan Amount**: $30,000 - $5,000 = $25,000

2. **Monthly Interest Rate**: 5% annual interest rate / 12 months = 0.4167%

3. **Number of Payments**: 10 years x 12 months = 120 payments

Using the loan payment formula:

\[

M = P \frac{r(1 + r)^n}{(1 + r)^n - 1}

\]

Where:

- M = total monthly payment

- P = loan amount ($25,000)

- r = monthly interest rate (0.004167)

- n = number of payments (120)

Plugging in the values, you can calculate your monthly payment.

#### Conclusion

To calculate boat loan payments effectively, it's crucial to understand the various components that contribute to your overall loan cost. By considering factors such as the purchase price, down payment, loan term, and interest rate, you can make informed decisions that will help you manage your finances better. Utilizing online calculators can further simplify this process, allowing you to explore different scenarios and find the best financing option for your new boat. Remember, thorough preparation and calculation can lead to a more enjoyable boating experience without the stress of financial strain.