Unlocking Financial Freedom: Exploring No Personal Guarantee Business Loans for Entrepreneurs

#### No Personal Guarantee Business LoansIn the world of entrepreneurship, securing funding is often a critical step towards growth and success. However, tr……

#### No Personal Guarantee Business Loans

In the world of entrepreneurship, securing funding is often a critical step towards growth and success. However, traditional lending options frequently require personal guarantees, putting personal assets at risk. This is where **no personal guarantee business loans** come into play, offering a unique solution for business owners looking for financial support without the added stress of personal liability.

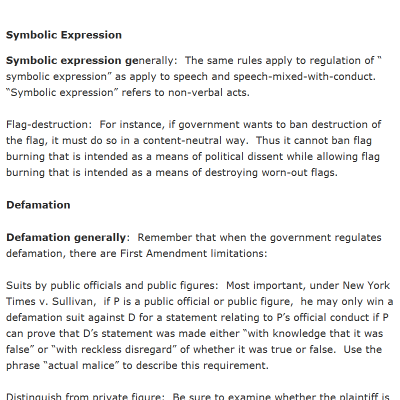

#### Understanding No Personal Guarantee Business Loans

**No personal guarantee business loans** are a type of financing that allows entrepreneurs to borrow money without having to put their personal assets on the line. This means that in the event of default, lenders cannot pursue personal assets such as your home or savings account. This type of loan is particularly appealing to small business owners who may not have substantial personal wealth or those who want to keep their personal and business finances separate.

#### Benefits of No Personal Guarantee Business Loans

1. **Reduced Risk**: One of the most significant advantages of these loans is the reduced financial risk. Business owners can focus on growing their companies without the constant worry of jeopardizing their personal finances.

2. **Accessibility**: Many lenders offering no personal guarantee loans have more flexible qualification criteria. This can be a game-changer for startups or businesses with less-than-perfect credit histories.

3. **Encouragement of Entrepreneurship**: By removing the personal guarantee requirement, lenders encourage more individuals to start their own businesses, fostering innovation and economic growth.

4. **Variety of Options**: There are various types of no personal guarantee loans available, including unsecured loans, lines of credit, and specific business loans tailored to different industries. This diversity allows entrepreneurs to find the right fit for their unique needs.

#### How to Qualify for No Personal Guarantee Business Loans

While no personal guarantee loans are generally more accessible, there are still criteria that borrowers must meet to qualify. Lenders typically evaluate the following:

- **Business Revenue**: A strong revenue stream can demonstrate the ability to repay the loan and may increase the chances of approval.

- **Business Credit Score**: Lenders often look at your business credit score, which reflects your business's creditworthiness and financial history.

- **Time in Business**: Established businesses with a track record may have an easier time securing these loans compared to newer startups.

- **Industry Stability**: Certain industries may be viewed as riskier than others, affecting loan availability and terms.

#### Where to Find No Personal Guarantee Business Loans

Several financial institutions and online lenders offer no personal guarantee business loans. Traditional banks, credit unions, and alternative lenders all provide different options. It is essential for business owners to shop around and compare terms, interest rates, and repayment schedules to find the best deal.

#### Conclusion

In conclusion, **no personal guarantee business loans** represent a valuable opportunity for entrepreneurs seeking financial assistance without risking their personal assets. By understanding the benefits, qualifications, and options available, business owners can make informed decisions that help propel their ventures forward. As the landscape of business financing continues to evolve, these loans are likely to play a crucial role in supporting the next generation of innovators and leaders.