How Much Will I Get Approved for a Home Loan? Discover Your Potential Home Buying Power Today!

Guide or Summary:Understanding Home Loan Approval AmountsFactors Influencing Home Loan ApprovalCalculating Your Home Loan Approval AmountThe Importance of P……

Guide or Summary:

- Understanding Home Loan Approval Amounts

- Factors Influencing Home Loan Approval

- Calculating Your Home Loan Approval Amount

- The Importance of Pre-Approval

- Tips for Improving Your Home Loan Approval Chances

Understanding Home Loan Approval Amounts

When it comes to purchasing a home, one of the most pressing questions prospective buyers ask is, "How much will I get approved for a home loan?". This question is crucial as it determines the range of properties you can consider and helps you set a realistic budget. Understanding the factors that influence your loan approval amount can empower you in your home-buying journey.

Factors Influencing Home Loan Approval

Several key factors play a significant role in determining how much you can get approved for a home loan. These include your credit score, income level, debt-to-income (DTI) ratio, and the type of loan you are seeking.

1. **Credit Score**: Your credit score is one of the most critical determinants of your loan approval amount. Lenders typically prefer borrowers with higher credit scores, as they are seen as less risky. A score above 700 usually opens the door to better interest rates and higher loan amounts.

2. **Income Level**: Lenders will assess your income to ensure you can afford monthly mortgage payments. The more stable and higher your income, the more likely you are to secure a larger loan.

3. **Debt-to-Income Ratio**: This ratio compares your monthly debt payments to your gross monthly income. Lenders prefer a DTI ratio below 43%, as it indicates that you are not over-leveraged and can manage additional debt responsibly.

4. **Loan Type**: Different loan types, such as FHA, VA, or conventional loans, have varying requirements and limits. Understanding these can help you determine how much you can realistically borrow.

Calculating Your Home Loan Approval Amount

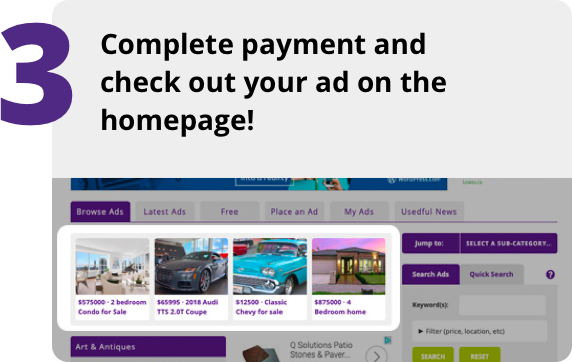

To get an estimate of how much you might be approved for, you can use online mortgage calculators. These tools allow you to input your income, debts, and credit score to provide a rough estimate of your borrowing potential. Additionally, speaking with a mortgage lender can give you a clearer picture of your financial standing and what you can expect.

The Importance of Pre-Approval

Before you start house hunting, obtaining a pre-approval letter from a lender is essential. This letter not only tells you how much you can borrow but also shows sellers that you are a serious buyer. The pre-approval process involves a thorough review of your finances, allowing you to understand your budget better and streamline your home-buying process.

Tips for Improving Your Home Loan Approval Chances

If you find that your initial approval amount is lower than expected, don’t be discouraged. There are several strategies you can employ to improve your chances of securing a higher loan amount:

1. **Improve Your Credit Score**: Pay down existing debts, make payments on time, and avoid taking on new debt before applying for a loan.

2. **Increase Your Income**: Consider part-time work or other income sources to bolster your financial profile.

3. **Reduce Your Debt**: Pay off credit cards and loans to lower your DTI ratio, making you a more attractive candidate for lenders.

4. **Save for a Larger Down Payment**: A larger down payment can reduce the loan amount needed and may improve your chances of approval.

Understanding "how much will I get approved for a home loan" is a vital step in the home-buying process. By considering the various factors that influence loan approval amounts and taking proactive steps to improve your financial standing, you can enhance your chances of securing the home of your dreams. Whether you are a first-time buyer or looking to upgrade, being informed and prepared will set you on the path to successful home ownership.