How to Get Home Loan: Your Ultimate Guide to Securing the Best Mortgage

When it comes to purchasing your dream home, understanding the intricacies of securing a mortgage can be overwhelming. If you're asking yourself, How to get……

When it comes to purchasing your dream home, understanding the intricacies of securing a mortgage can be overwhelming. If you're asking yourself, How to get home loan, you're not alone. Many prospective homeowners find themselves in a maze of information and options. This comprehensive guide will walk you through the essential steps to obtain a home loan, ensuring you are well-equipped to make informed decisions.

#### Understanding Home Loans

First, let’s break down what a home loan is. A home loan, also known as a mortgage, is a financial agreement between you and a lender that allows you to borrow money to purchase a property. In return, you agree to repay the loan amount, plus interest, over a specified period. The property itself typically serves as collateral, meaning if you fail to repay the loan, the lender can take possession of your home.

#### Steps to Get a Home Loan

1. **Assess Your Financial Situation**: Before diving into the mortgage application process, take a close look at your finances. This includes evaluating your credit score, income, debts, and savings. A higher credit score can lead to better loan terms, so if your score needs improvement, consider taking steps to enhance it before applying.

2. **Determine Your Budget**: Knowing how much you can afford is crucial. Use a mortgage calculator to estimate your monthly payments based on different loan amounts, interest rates, and terms. Don’t forget to factor in additional costs such as property taxes, insurance, and maintenance.

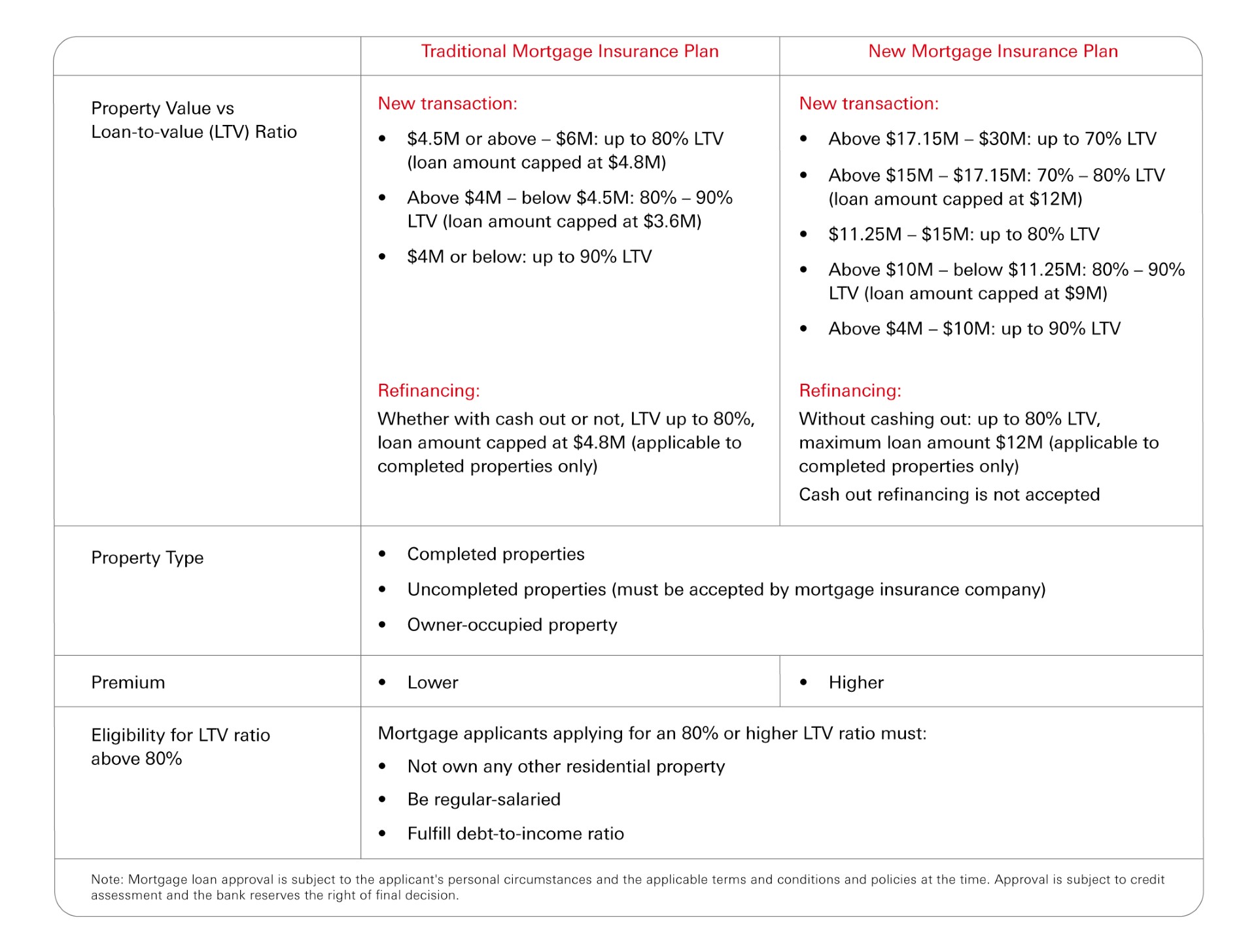

3. **Research Loan Options**: There are various types of home loans available, including fixed-rate mortgages, adjustable-rate mortgages (ARMs), FHA loans, VA loans, and more. Each type has its own advantages and disadvantages, so it’s important to research which option aligns best with your financial goals.

4. **Get Pre-Approved**: Once you have a clear understanding of your finances and loan options, consider getting pre-approved for a mortgage. This process involves a lender reviewing your financial information to determine how much they are willing to lend you. Pre-approval not only gives you a clearer picture of your budget but also shows sellers that you are a serious buyer.

5. **Shop Around for Lenders**: Don’t settle for the first lender you come across. Different lenders offer varying interest rates, fees, and terms. Obtain quotes from multiple lenders and compare them to find the best deal. Look for lenders with good customer service and positive reviews.

6. **Prepare Your Documentation**: When you’re ready to apply for a loan, be prepared to provide a variety of documents. This typically includes proof of income (such as pay stubs and tax returns), bank statements, and information about your debts and assets. Having these documents ready can streamline the application process.

7. **Submit Your Application**: After selecting a lender and preparing your documents, it’s time to submit your application. Be honest and thorough in your responses to avoid delays in the approval process.

8. **Close the Loan**: If your application is approved, you’ll move on to the closing process. This involves signing a lot of paperwork and paying closing costs. Once everything is finalized, you’ll receive the keys to your new home!

#### Conclusion

In summary, How to get home loan is a question that many aspiring homeowners ask. By understanding the steps involved, assessing your financial situation, and doing thorough research, you can navigate the mortgage process with confidence. Remember, securing a home loan is a significant financial commitment, so take your time and make informed decisions. With the right preparation and knowledge, you’ll be well on your way to owning your dream home.