# Lending Loan Calculator: Your Ultimate Tool for Smart Borrowing Decisions

In today's fast-paced financial landscape, understanding your borrowing options is crucial. Whether you're looking to finance a new home, purchase a vehicle……

In today's fast-paced financial landscape, understanding your borrowing options is crucial. Whether you're looking to finance a new home, purchase a vehicle, or consolidate debt, a Lending Loan Calculator can be your best ally. This powerful tool not only simplifies the complex world of loans but also empowers you to make informed financial decisions that align with your budget and goals.

## Why Use a Lending Loan Calculator?

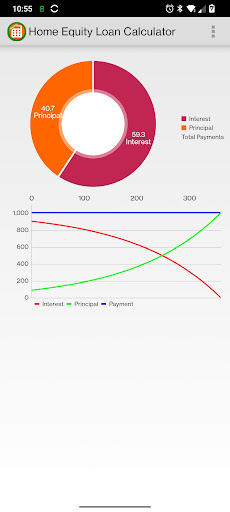

Using a Lending Loan Calculator offers numerous benefits that can significantly impact your financial journey. First and foremost, it provides clarity. With just a few inputs, you can see how different loan amounts, interest rates, and repayment terms affect your monthly payments and total interest paid over the life of the loan. This transparency is invaluable, especially for first-time borrowers who may feel overwhelmed by the intricacies of loan agreements.

Moreover, a Lending Loan Calculator allows you to experiment with various scenarios. For instance, if you're unsure whether to opt for a 15-year or a 30-year mortgage, the calculator can quickly show you the financial implications of each choice. This feature enables you to visualize your financial future and select the option that best suits your lifestyle and long-term objectives.

## How to Use a Lending Loan Calculator

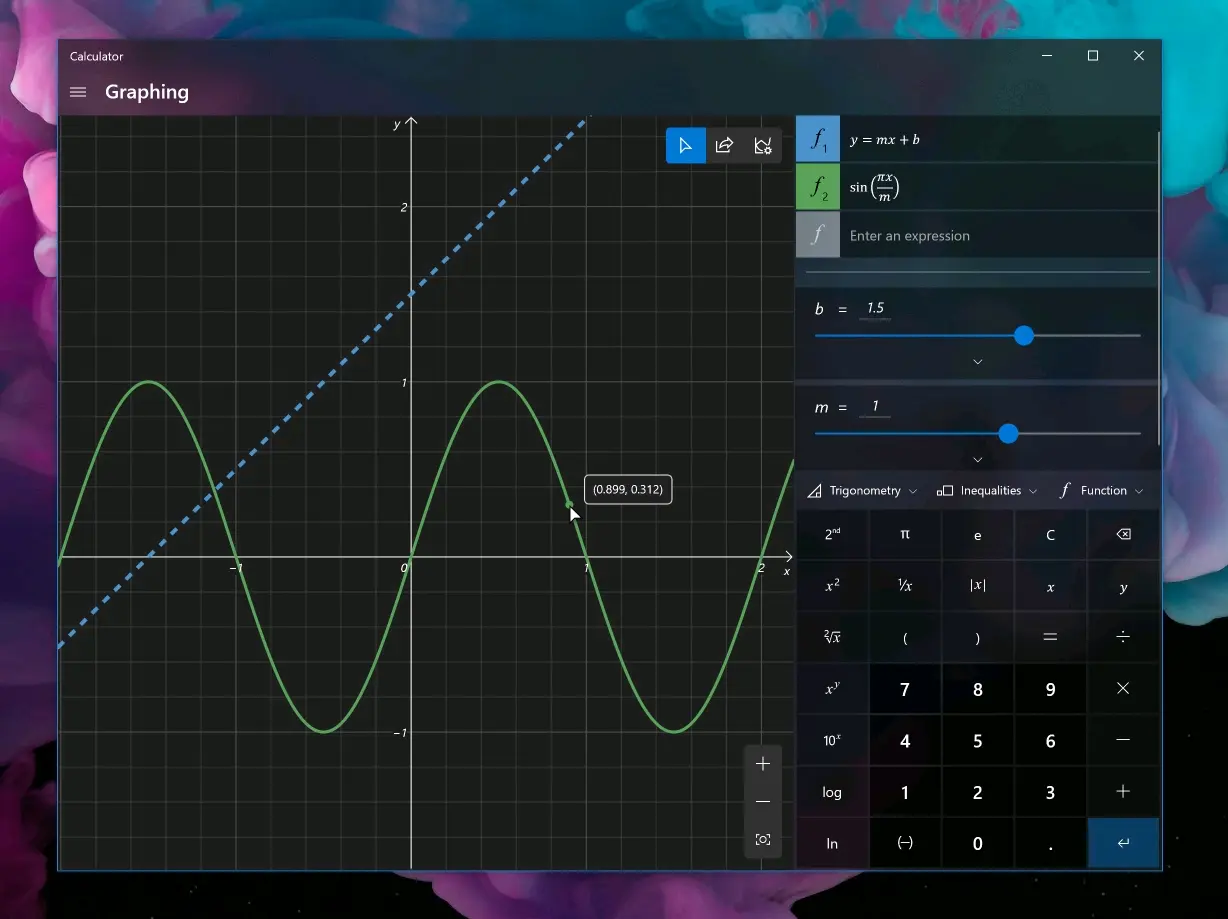

Using a Lending Loan Calculator is straightforward. Start by entering the loan amount you wish to borrow. Next, input the interest rate, which can vary based on your credit score and lender policies. Finally, specify the loan term in months or years. Once you hit "calculate," the tool will provide you with a detailed breakdown of your monthly payments, total interest paid, and even an amortization schedule.

This user-friendly interface makes it easy for anyone, regardless of financial expertise, to navigate the loan landscape. Additionally, many calculators offer advanced features, such as the ability to factor in extra payments or compare multiple loan options side by side.

## The Importance of Accurate Inputs

While a Lending Loan Calculator is a powerful tool, its effectiveness relies on the accuracy of the information you provide. Ensure that you input realistic figures for your loan amount and interest rate. Research current market rates and consider your credit profile to get a more accurate estimate. The more precise your inputs, the more useful the calculator will be in guiding your borrowing decisions.

## Making Informed Decisions

Armed with the insights gained from a Lending Loan Calculator, you can approach lenders with confidence. You'll have a clearer understanding of what you can afford and what terms are reasonable. This knowledge not only helps you negotiate better deals but also protects you from falling into debt traps that come from overborrowing or accepting unfavorable terms.

## Conclusion

In conclusion, a Lending Loan Calculator is an essential tool for anyone looking to navigate the complex world of loans. By providing clarity and enabling you to explore various borrowing scenarios, it empowers you to make informed financial decisions. Whether you're a seasoned borrower or a first-timer, incorporating this calculator into your financial planning will help you achieve your goals while minimizing stress and uncertainty. So why wait? Start using a Lending Loan Calculator today and take control of your financial future!