Can I Balance Transfer a Loan to a Credit Card? Discover the Benefits and Strategies!

When it comes to managing your finances, one question that often arises is, can I balance transfer a loan to a credit card? This query is particularly relev……

When it comes to managing your finances, one question that often arises is, can I balance transfer a loan to a credit card? This query is particularly relevant for those looking to consolidate debt, lower interest rates, or simply streamline their financial obligations. In this comprehensive guide, we will explore the ins and outs of balance transfers, the potential benefits, and the strategies you can employ to make the most of this financial maneuver.

### Understanding Balance Transfers

A balance transfer typically refers to the process of moving debt from one account to another, often from a credit card with a high-interest rate to one with a lower rate. However, the concept of transferring a loan balance—such as a personal loan or an auto loan—to a credit card is less common but can be beneficial in certain circumstances. So, can I balance transfer a loan to a credit card? The answer is yes, but it requires careful planning and consideration.

### Why Consider a Balance Transfer?

1. **Lower Interest Rates**: One of the most compelling reasons to consider transferring a loan to a credit card is the potential for lower interest rates. Many credit cards offer promotional rates for balance transfers, which can significantly reduce the amount of interest you pay over time.

2. **Simplified Payments**: Managing multiple loans can be cumbersome. By consolidating your debt onto a single credit card, you simplify your financial life. This can help you stay organized and make it easier to track your payments.

3. **Improved Credit Score**: If you’re able to pay down your debt more effectively through a balance transfer, you may see improvements in your credit score over time. Lowering your credit utilization ratio by paying off loans can positively impact your score.

### How to Execute a Balance Transfer

If you’re considering making the leap, here are some steps to guide you through the process:

1. **Check Your Credit Card Limits**: Before proceeding, check if your credit card has enough available credit to accommodate the loan amount you wish to transfer. Most credit cards have limits that may restrict how much you can transfer.

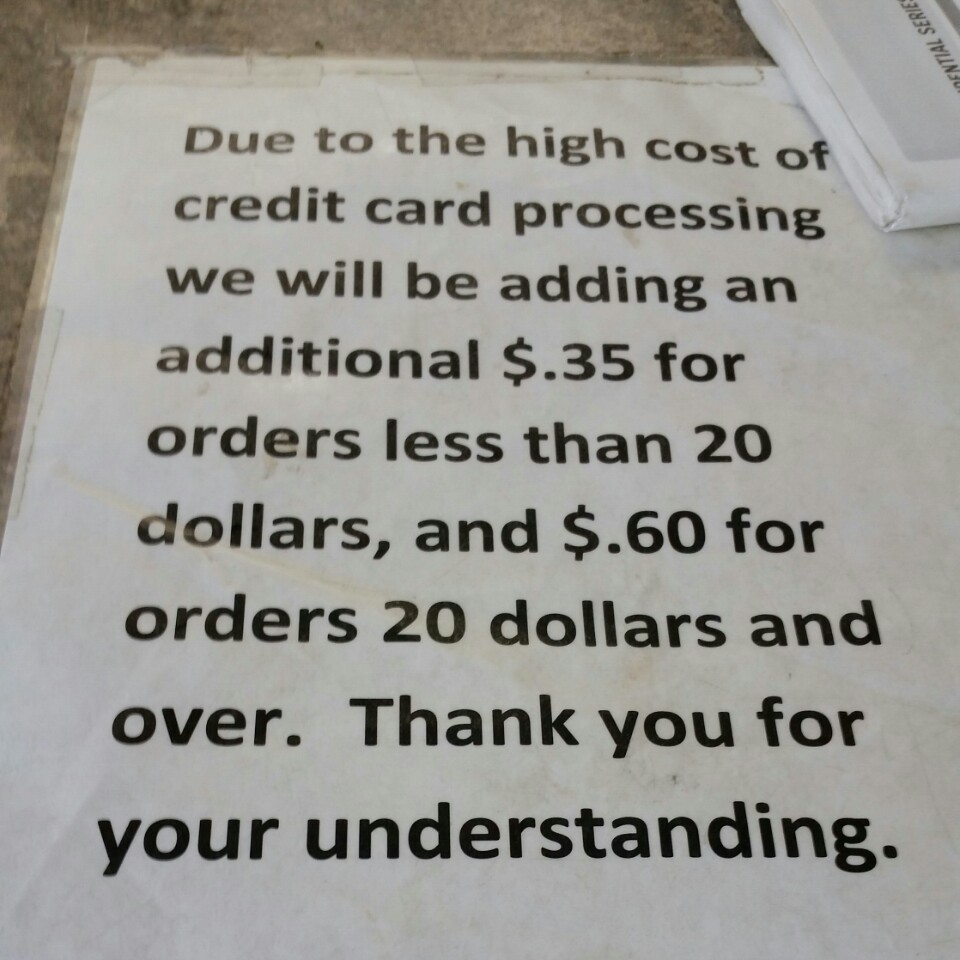

2. **Review Terms and Fees**: Not all credit cards are created equal. Some may charge balance transfer fees, which can range from 3% to 5% of the amount transferred. Make sure to read the fine print to understand any potential costs involved.

3. **Apply for a Card with a Promotional Rate**: Look for credit cards that offer 0% APR promotional rates for balance transfers. This can save you a significant amount in interest if you can pay off the balance before the promotional period ends.

4. **Initiate the Transfer**: Once you’ve chosen the right card, contact your credit card issuer to initiate the balance transfer. Provide them with the necessary information about your loan and the amount you wish to transfer.

5. **Create a Repayment Plan**: After the transfer is complete, develop a plan to pay off your new balance. Aim to pay more than the minimum payment to avoid accruing interest once the promotional rate expires.

### Potential Pitfalls to Avoid

While transferring a loan to a credit card can be advantageous, there are potential pitfalls to be aware of:

- **High Interest Rates Post-Promotion**: Once the promotional period ends, the interest rate may increase significantly. Be prepared to pay off the balance before this happens.

- **Impact on Credit Utilization**: If the balance transfer pushes your credit utilization ratio too high, it could negatively affect your credit score. Aim to keep your utilization below 30%.

- **Fees**: As mentioned earlier, balance transfer fees can add up. Make sure the savings from lower interest outweigh these costs.

### Conclusion

In summary, can I balance transfer a loan to a credit card? Yes, it is possible, and it can be a smart financial move if executed correctly. By understanding the benefits, following the right steps, and being aware of potential pitfalls, you can take control of your debt and improve your financial situation. Always consult with a financial advisor if you’re unsure about the best course of action for your unique circumstances. With the right strategy, a balance transfer could be your ticket to financial freedom!