Credit Card Consolidation Loan Bad Credit: Your Pathway to Financial Freedom

Guide or Summary:Credit CardConsolidation LoanBad CreditYour Pathway to Financial FreedomIn the ever-evolving landscape of personal finance, managing debt h……

Guide or Summary:

In the ever-evolving landscape of personal finance, managing debt has become a critical skill for maintaining financial stability. For many, the prospect of consolidating multiple credit card debts into a single, manageable loan is an attractive option. However, individuals with bad credit face unique challenges when attempting to secure such a loan. This comprehensive guide delves into the intricacies of credit card consolidation loans for those with less-than-stellar credit, offering insights, strategies, and resources to navigate this complex financial journey.

Credit Card

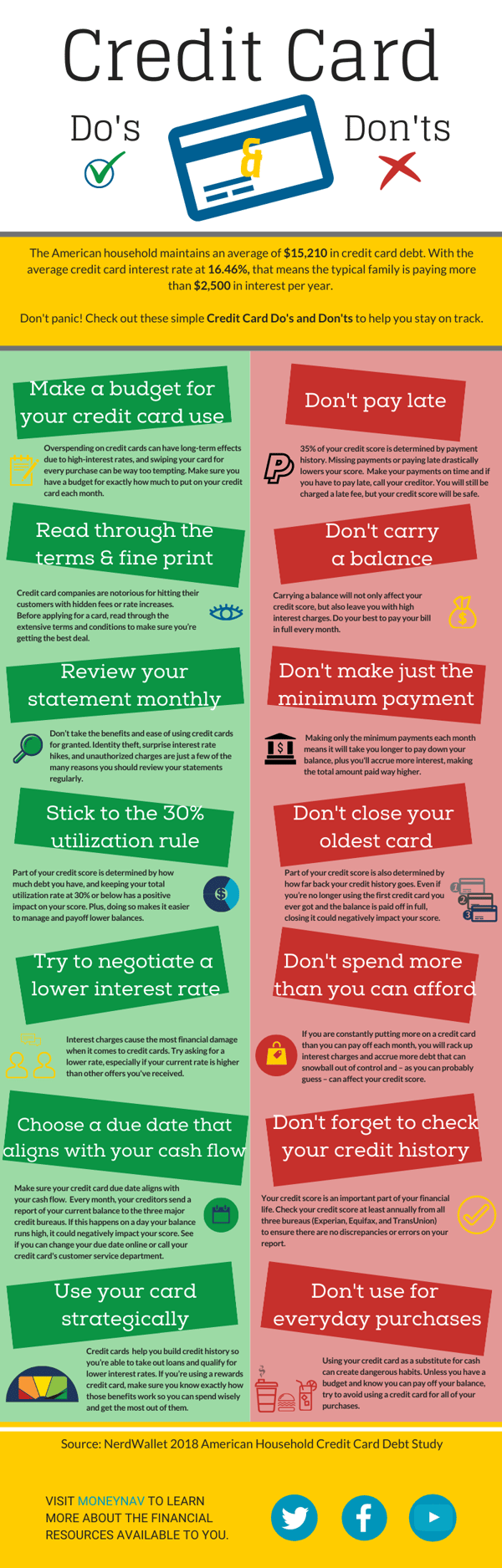

Credit cards have become an integral part of modern consumer spending, offering convenience and flexibility. However, the allure of easy credit can quickly lead to a cycle of debt if not managed responsibly. High-interest rates, late fees, and the temptation to overspend are just a few reasons why credit card debt can spiral out of control.

Consolidation Loan

A consolidation loan is a financial tool designed to simplify the repayment of multiple debts into a single, monthly payment. This approach can streamline budgeting, reduce interest costs, and provide a clear timeline for debt repayment. However, for individuals with bad credit, securing a consolidation loan can be a daunting task.

Bad Credit

Bad credit is a term used to describe a borrower's creditworthiness, typically indicated by a low credit score. Factors such as missed payments, high levels of debt, and a history of defaults contribute to a poor credit rating. Those with bad credit often face higher interest rates, limited credit options, and a challenging path to financial recovery.

Your Pathway to Financial Freedom

For individuals with bad credit, the journey towards financial freedom through credit card consolidation loans requires a strategic approach. Here are key strategies to navigate this complex process:

1. **Credit Score Assessment**: Begin by evaluating your current credit score and identifying areas for improvement. Paying down outstanding debts, making timely payments, and reducing credit utilization can positively impact your credit score over time.

2. **Research Loan Options**: Explore various loan options available for consolidating credit card debt. Look for lenders that specialize in bad credit loans or those offering flexible repayment terms tailored to your financial situation.

3. **Comparison Shopping**: Compare interest rates, fees, and repayment terms from multiple lenders. A lower interest rate can significantly reduce the overall cost of consolidating your debt, making it a more affordable option.

4. **Securing Collateral**: In some cases, securing collateral, such as a car or savings account, may be necessary to obtain a consolidation loan. This step can help mitigate the lender's risk and improve your chances of loan approval.

5. **Budgeting and Financial Planning**: Develop a realistic budget and financial plan to ensure you can afford the monthly payments associated with the consolidation loan. Consistent and timely payments are crucial to maintaining a good credit score and avoiding default.

6. **Seek Professional Advice**: Consider consulting with a financial advisor or credit counselor who can provide personalized advice and strategies for managing your debt. Their expertise can be invaluable in navigating the complexities of credit card consolidation loans.

In conclusion, credit card consolidation loans for those with bad credit can be a viable solution for achieving financial freedom. By taking a strategic approach, assessing your credit score, researching loan options, and developing a sound financial plan, you can navigate the challenges associated with bad credit and secure the loan you need to consolidate your debts. With determination and the right financial tools, a path to a debt-free future is within reach.