Mortgage Loan Types: Understanding Your Options for Home Financing

Guide or Summary:Fixed-Rate MortgagesAdjustable-Rate Mortgages (ARMs)Interest-Only MortgagesGraduated Payment MortgagesReverse MortgagesGovernment-Insured M……

Guide or Summary:

- Fixed-Rate Mortgages

- Adjustable-Rate Mortgages (ARMs)

- Interest-Only Mortgages

- Graduated Payment Mortgages

- Reverse Mortgages

- Government-Insured Mortgages

When it comes to purchasing a home, one of the most critical decisions you will face is selecting the right mortgage loan type. With a myriad of options available, it can be overwhelming to choose the best fit for your financial situation, goals, and risk tolerance. This comprehensive guide will delve into various mortgage loan types, helping you make an informed decision that aligns with your long-term objectives.

Fixed-Rate Mortgages

A fixed-rate mortgage is perhaps the most traditional and widely chosen type of mortgage. With this option, your interest rate remains constant throughout the life of the loan, providing a predictable monthly payment. This stability can be particularly appealing to borrowers who prefer a consistent budget. Fixed-rate mortgages are available in various terms, ranging from 10 to 30 years, allowing you to choose a repayment period that best fits your financial situation.

Adjustable-Rate Mortgages (ARMs)

ARMs offer a different kind of predictability by starting with a fixed interest rate for an initial term, typically between 5 and 7 years. After this period, the rate adjusts annually based on a predetermined index, such as the LIBOR or the Treasury bill rate. This can result in lower initial payments and a lower overall interest cost if interest rates decrease. However, if rates rise, your monthly payments and interest costs will increase as well. ARMs are best suited for borrowers who anticipate moving or refinancing before the rate adjustment period ends.

Interest-Only Mortgages

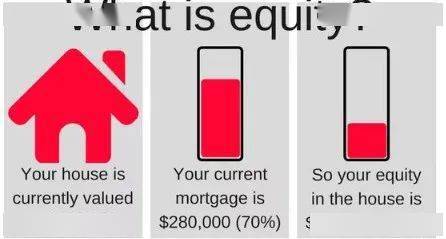

Interest-only mortgages, also known as option adjustable-rate mortgages (Option ARMs), allow borrowers to make payments that cover only the interest portion of the loan for a specified term, typically 5 to 10 years. This means that the principal balance remains unchanged during this period, and borrowers do not build equity. However, at the end of the initial term, borrowers must either refinance the loan or switch to a new payment plan that includes principal repayment. This type of mortgage can be attractive to those looking to minimize initial payments, but it comes with the risk of owing more than the property's value if rates rise or the borrower fails to refinance.

Graduated Payment Mortgages

Graduated payment mortgages offer a unique payment structure that starts with lower monthly payments and gradually increases over time. This is achieved by allocating a larger portion of the initial payments to interest and a smaller portion to principal. As the loan matures, the payments shift to a more traditional structure where a larger portion goes towards principal repayment. This can be beneficial for borrowers who expect their income to increase over time, allowing them to afford higher payments later on.

Reverse Mortgages

Reverse mortgages are designed for homeowners aged 62 and older who wish to access the equity in their homes without having to sell or move. With a reverse mortgage, you receive money from a lender based on the equity in your home, which is repaid with interest over time. This can be a valuable option for retirees looking to supplement their income or cover healthcare costs, without the hassle of downsizing.

Government-Insured Mortgages

Government-insured mortgages, such as those offered by the Federal Housing Administration (FHA), the Veterans Administration (VA), and the Department of Agriculture (USDA), provide additional security for borrowers. These loans often require lower down payments and have more lenient credit requirements compared to conventional mortgages. They are designed to make homeownership more accessible to a broader range of borrowers, including first-time homebuyers, low-income individuals, and those with less-than-perfect credit.

Choosing the right mortgage loan type is a crucial step in the homebuying process. By understanding the various options available and considering your financial situation, goals, and risk tolerance, you can select a mortgage that aligns with your long-term objectives. Remember to consult with a financial advisor or mortgage professional to help navigate the complexities of mortgage lending and make an informed decision that sets the foundation for a secure financial future.