Understanding the Process: Can Home Loan Be Transferred to Another Person?

Guide or Summary:IntroductionWhat Does It Mean to Transfer a Home Loan?Eligibility CriteriaSteps to Transfer a Home LoanPotential ChallengesAlternatives to……

Guide or Summary:

- Introduction

- What Does It Mean to Transfer a Home Loan?

- Eligibility Criteria

- Steps to Transfer a Home Loan

- Potential Challenges

- Alternatives to Loan Transfer

**Translation:** Can home loan be transferred to another person?

---

Introduction

When it comes to homeownership, many individuals find themselves in situations where they need to consider transferring their home loan to another person. This brings us to the question: can home loan be transferred to another person? Understanding the nuances of this process is crucial for anyone looking to navigate the complexities of mortgage transfers.

What Does It Mean to Transfer a Home Loan?

Transferring a home loan essentially means that the existing mortgage obligation is moved from one borrower to another. This can occur for various reasons, such as a divorce, financial hardship, or simply wanting to sell the home to a family member or friend without going through the traditional selling process.

Eligibility Criteria

Before considering a transfer, it's important to understand the eligibility criteria. Not all loans are transferable. Most conventional loans have a due-on-sale clause, which means that when the property is sold, the lender has the right to demand full repayment of the loan. However, some loans, like FHA and VA loans, may allow for easier transfer under certain conditions.

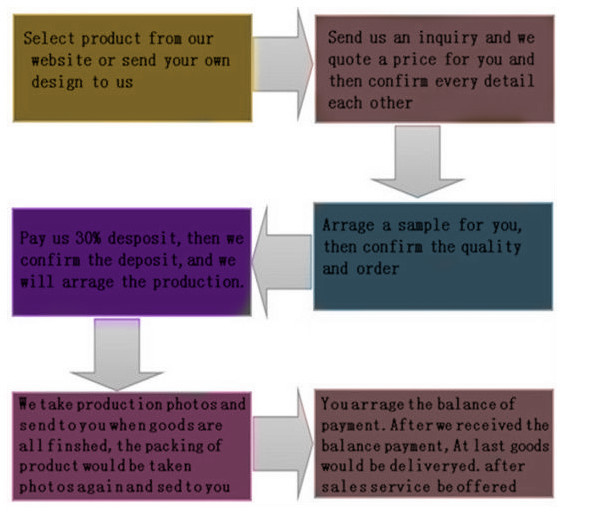

Steps to Transfer a Home Loan

1. **Check Your Loan Agreement**: The first step is to review your mortgage documents. Look for any clauses related to loan transferability.

2. **Contact Your Lender**: Speak with your mortgage lender to understand their policies regarding loan transfers. They will provide guidance on whether the loan can be transferred and what the process entails.

3. **Obtain Consent**: If the loan is transferable, the lender will likely require the new borrower to apply for the mortgage and meet their credit and income requirements.

4. **Complete Necessary Documentation**: Both parties will need to complete and sign various documents to formalize the transfer. This may include a loan assumption agreement, which outlines the terms of the transfer.

5. **Close the Transaction**: Finally, the transfer will need to be closed formally, similar to a home sale. This often involves a title company to ensure all legalities are met.

Potential Challenges

Transferring a home loan can come with its share of challenges. One major issue is the creditworthiness of the new borrower. If the person taking over the loan does not meet the lender's criteria, the transfer may not be approved. Additionally, there may be fees associated with the transfer process, which can add to the financial burden.

Alternatives to Loan Transfer

If transferring a home loan proves to be too complicated or not feasible, there are alternatives to consider. Selling the home outright and paying off the mortgage is one option. Another alternative is refinancing the existing loan, which allows the new borrower to take out a new mortgage in their name.

In conclusion, the question of can home loan be transferred to another person? is a nuanced one. While it is possible under certain conditions, it requires careful consideration of the loan terms, lender policies, and the financial situation of both parties involved. Always consult with a financial advisor or real estate professional to explore your options and ensure a smooth transition in the home loan transfer process. Understanding the ins and outs of this process can save both time and money in the long run.