Understanding What is Refinancing Home Loan: A Comprehensive Guide to Lowering Your Mortgage Payments

#### What is Refinancing Home LoanRefinancing a home loan is the process of replacing your current mortgage with a new one, often with better terms, such as……

#### What is Refinancing Home Loan

Refinancing a home loan is the process of replacing your current mortgage with a new one, often with better terms, such as a lower interest rate or a different loan duration. This financial strategy can lead to significant savings over time and is a popular choice among homeowners looking to improve their financial situation.

#### Why Consider Refinancing?

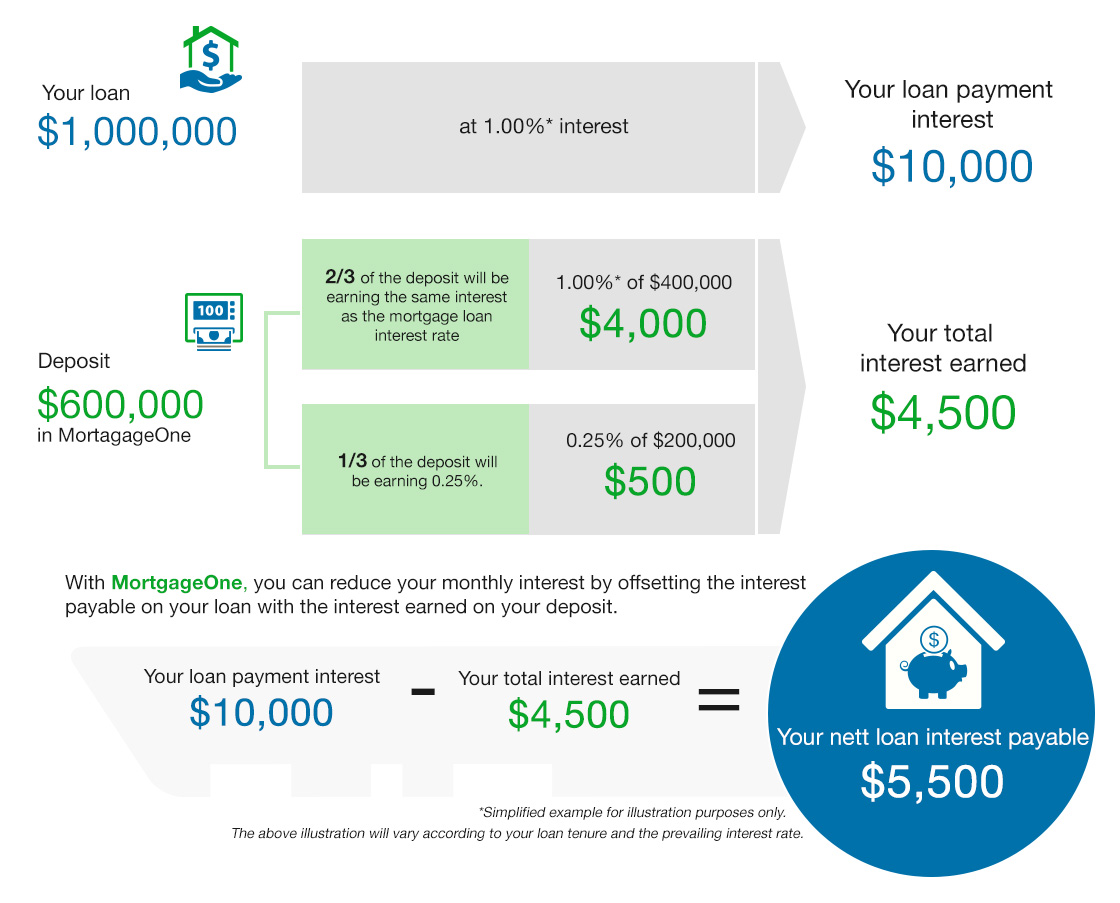

There are several reasons why homeowners might consider refinancing their home loans. One of the primary motivations is to take advantage of lower interest rates. If market rates have dropped since you first took out your mortgage, refinancing could reduce your monthly payments and the total interest paid over the life of the loan.

Another reason to refinance is to change the loan term. Homeowners may want to switch from a 30-year mortgage to a 15-year mortgage to pay off their home faster and save on interest costs. Conversely, extending the loan term can lower monthly payments, providing more immediate financial relief.

![]()

#### Types of Refinancing

There are two main types of refinancing: rate-and-term refinancing and cash-out refinancing. Rate-and-term refinancing is focused on obtaining a lower interest rate or altering the loan term without withdrawing any equity from the home. On the other hand, cash-out refinancing allows homeowners to take out a new mortgage for more than they owe on their existing loan, providing them with cash to use for other expenses, such as home renovations or debt consolidation.

#### The Refinancing Process

The refinancing process typically involves several steps. First, homeowners should assess their current financial situation and determine their goals for refinancing. Next, they should shop around for lenders to find the best rates and terms. It's essential to compare offers and understand the associated fees, such as closing costs, which can impact the overall savings from refinancing.

Once a lender is chosen, the homeowner will need to complete a loan application and provide necessary documentation, including income verification and credit history. The lender will then conduct an appraisal to determine the home's current value. If everything checks out, the loan will be approved, and the refinancing process will be completed, usually within a few weeks.

#### Pros and Cons of Refinancing

While refinancing can offer numerous benefits, it's essential to weigh the pros and cons. The advantages include lower monthly payments, reduced interest rates, and the potential for accessing home equity. However, there are also drawbacks to consider, such as closing costs and the possibility of extending the loan term, which could result in paying more interest over time.

#### Conclusion

In summary, understanding what is refinancing home loan is crucial for homeowners looking to improve their financial situation. By evaluating their options, comparing lenders, and understanding the refinancing process, homeowners can make informed decisions that align with their financial goals. Whether it's lowering monthly payments or accessing cash for other needs, refinancing can be a powerful financial tool when used wisely.