Unlocking Homeownership: How a 40 Year Loan Calculator Can Transform Your Mortgage Journey

#### Understanding the 40 Year Loan CalculatorA 40 year loan calculator is an essential tool for anyone considering a long-term mortgage option. This calcul……

#### Understanding the 40 Year Loan Calculator

A 40 year loan calculator is an essential tool for anyone considering a long-term mortgage option. This calculator helps prospective homeowners determine their monthly payments, total interest paid over the life of the loan, and how different interest rates can impact their financial commitment. By inputting the loan amount, interest rate, and loan term, users can easily visualize their financial obligations and make informed decisions.

#### The Benefits of a 40 Year Mortgage

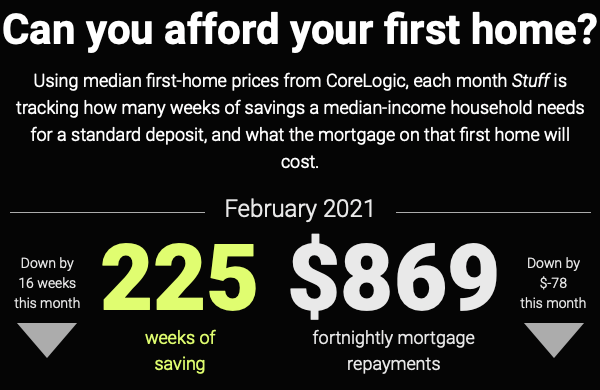

Opting for a 40 year mortgage has several advantages. One of the most significant benefits is the lower monthly payment compared to shorter-term loans. This can be particularly appealing for first-time homebuyers or those looking to manage their monthly budget more effectively. By spreading the loan repayment over a longer period, homeowners can free up cash for other expenses, such as home improvements, education, or savings.

Additionally, a 40 year mortgage can provide access to higher loan amounts, making it easier for buyers to purchase their dream homes in competitive real estate markets. The extended loan term can also help borrowers qualify for loans that they might not otherwise be able to afford.

#### Calculating Your Future with a 40 Year Loan Calculator

Using a 40 year loan calculator is straightforward. Simply enter the total loan amount you wish to borrow, the interest rate offered by your lender, and the loan term of 40 years. The calculator will then provide you with a breakdown of your monthly payments, total interest paid over the life of the loan, and the total cost of the mortgage. This information is invaluable for budgeting and financial planning.

For instance, if you were to borrow $300,000 at a 4% interest rate over 40 years, your monthly payment would be significantly lower than if you opted for a 30-year loan. However, it’s essential to consider the total interest paid, which will be higher with a longer loan term. A 40 year loan calculator helps you weigh these factors effectively.

#### Comparing 40 Year Loans to Other Options

When considering a mortgage, it’s crucial to compare a 40 year loan with other available options, such as 30-year or 15-year loans. While the longer term of a 40 year mortgage means lower monthly payments, it also results in more interest paid over time. A 30-year loan may have higher monthly payments but will save you money in interest in the long run.

Using a 40 year loan calculator can help you visualize these differences. By adjusting the loan term and interest rates, you can see how your monthly payments and total interest change, allowing you to make a more informed decision based on your financial situation and long-term goals.

#### Is a 40 Year Mortgage Right for You?

Deciding whether a 40 year mortgage is the right choice for you depends on your financial situation, future plans, and comfort level with debt. If you prioritize lower monthly payments and have a stable income, a 40 year mortgage might be an excellent option. However, if you aim to pay off your debt sooner and save on interest, you might want to consider a shorter loan term.

Ultimately, a 40 year loan calculator is a powerful tool that can aid in your decision-making process. By understanding your options and calculating potential costs, you can confidently navigate the complexities of home financing and take a significant step towards homeownership. Remember, always consult with a financial advisor or mortgage professional to ensure that you make the best choice for your unique circumstances.