How to Access Your Possible Loan Login: A Step-by-Step Guide for Borrowers

#### Understanding Possible Loan LoginPossible Loan Login is a crucial aspect for individuals seeking to manage their loans online. This platform allows bor……

#### Understanding Possible Loan Login

Possible Loan Login is a crucial aspect for individuals seeking to manage their loans online. This platform allows borrowers to access their accounts, check balances, make payments, and update personal information conveniently. Understanding how to navigate the Possible Loan Login process is essential for maintaining your financial health and ensuring that you stay on top of your loan obligations.

#### Why Use Possible Loan Login?

Using the Possible Loan Login feature provides numerous advantages. Firstly, it offers 24/7 access to your loan account, meaning you can check your status or make payments at any time that suits you. This flexibility is particularly beneficial for those with busy schedules who may not have the time to visit a physical location.

Moreover, online access allows for quick and easy communication with customer service. If you have questions or concerns about your loan, you can often find answers through the online portal or submit inquiries directly. This can save you time and reduce the frustration of waiting on hold for phone support.

#### How to Access Your Possible Loan Login

Accessing your Possible Loan Login is a straightforward process. Here’s a step-by-step guide to help you get started:

1. **Visit the Official Website**: Begin by navigating to the official Possible Loan website. Ensure that you are on a secure connection to protect your personal information.

2. **Locate the Login Section**: On the homepage, look for the login section. This is typically found in the upper right corner of the page. Click on the “Login” button.

3. **Enter Your Credentials**: You will be prompted to enter your username and password. Make sure to input the correct details to avoid being locked out of your account.

4. **Forgotten Password?**: If you’ve forgotten your password, there is usually a “Forgot Password” link that you can click on. Follow the instructions provided to reset your password and regain access to your account.

5. **Explore Your Account**: Once logged in, take the time to familiarize yourself with the dashboard. You’ll find various options to manage your loan, such as viewing your balance, making payments, and accessing payment history.

#### Tips for a Smooth Possible Loan Login Experience

To ensure a smooth experience when logging into your Possible Loan account, consider the following tips:

- **Keep Your Credentials Secure**: Always keep your login information private and secure. Avoid sharing your password with anyone and consider changing it regularly.

- **Use a Secure Connection**: When accessing your account, make sure you are using a secure internet connection. Avoid public Wi-Fi networks, as they can be less secure and may put your information at risk.

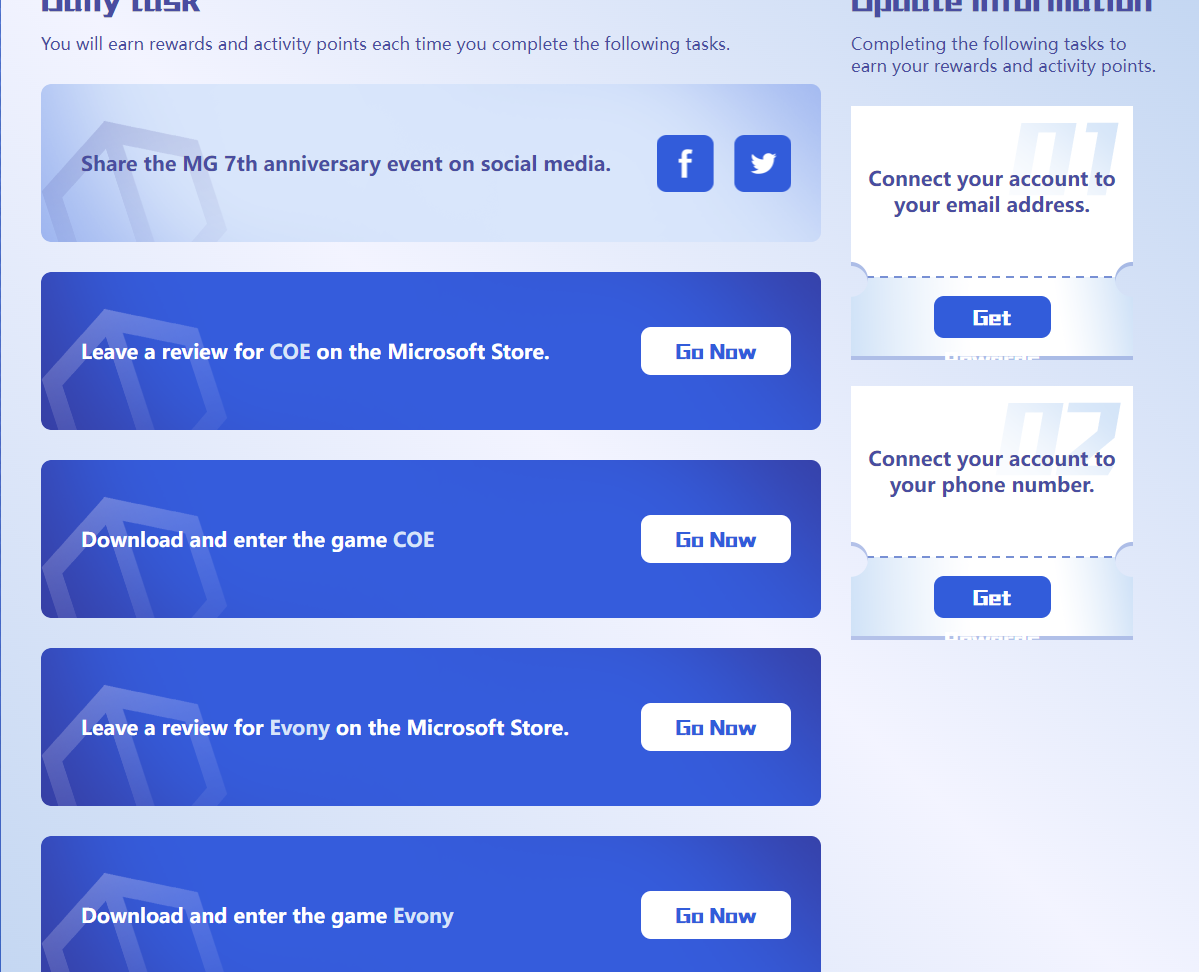

- **Update Your Information**: Regularly check and update your personal information, such as your email address and phone number, to ensure that you receive important notifications regarding your loan.

- **Contact Customer Support**: If you encounter any issues during the login process, don’t hesitate to reach out to customer support for assistance. They can help troubleshoot any problems you may face.

#### Conclusion

In conclusion, the Possible Loan Login is an essential tool for borrowers looking to manage their loans efficiently. By understanding how to access your account and utilizing the features available, you can take control of your financial obligations. Remember to keep your login information secure and reach out for help if needed. With these tips, you can navigate the Possible Loan Login process with ease and confidence, ensuring that you stay on top of your loan management.