"Understanding Tax Deductions: Is the Interest on a Car Loan Tax Deductible?"

---#### Is the Interest on a Car Loan Tax Deductible?When considering the financial implications of purchasing a vehicle, many borrowers often wonder about……

---

#### Is the Interest on a Car Loan Tax Deductible?

When considering the financial implications of purchasing a vehicle, many borrowers often wonder about the potential tax benefits associated with their car loans. Specifically, a common question arises: **Is the interest on a car loan tax deductible?** This inquiry is crucial for anyone looking to optimize their tax situation while managing their vehicle financing.

#### What Does Tax Deductible Mean?

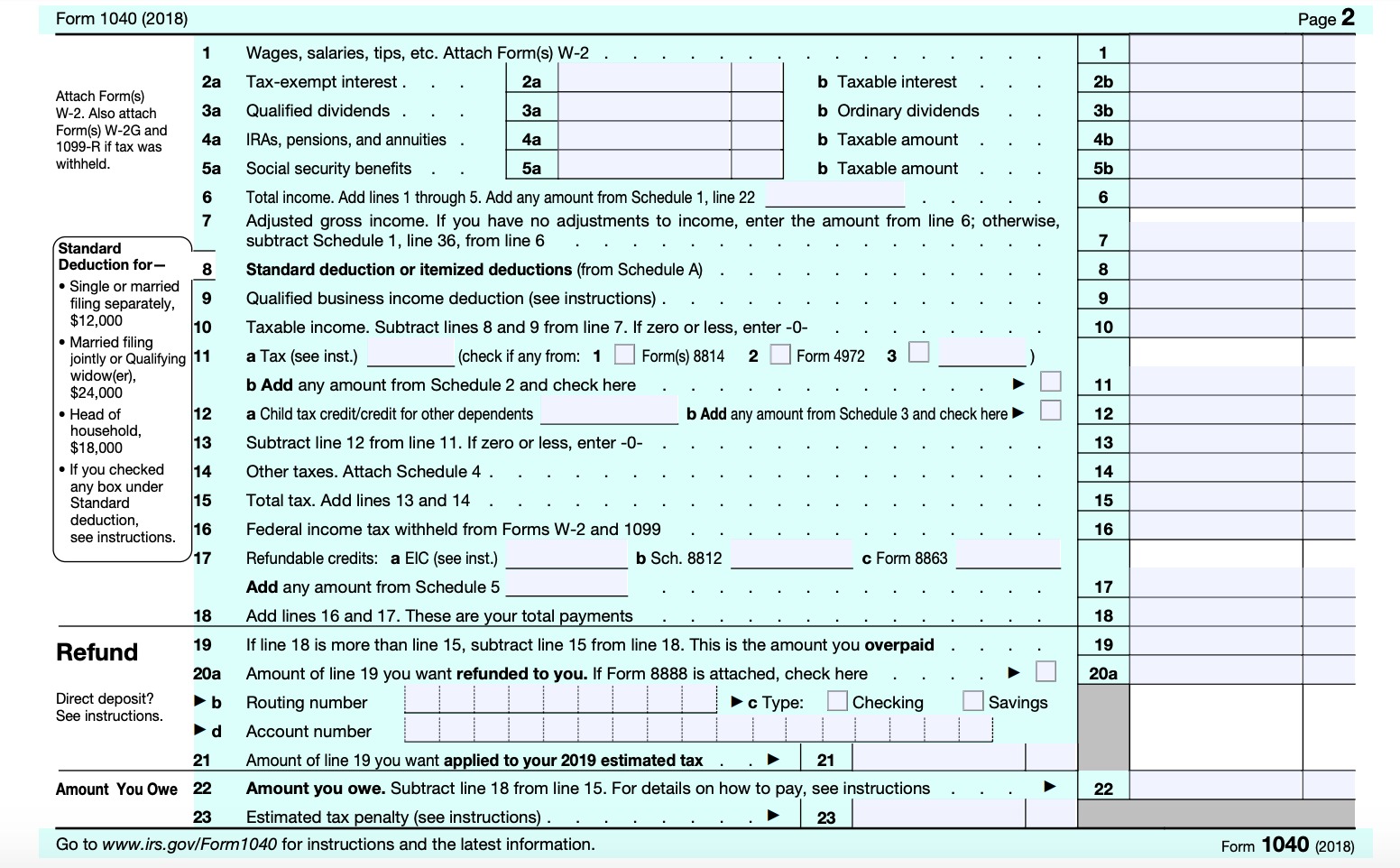

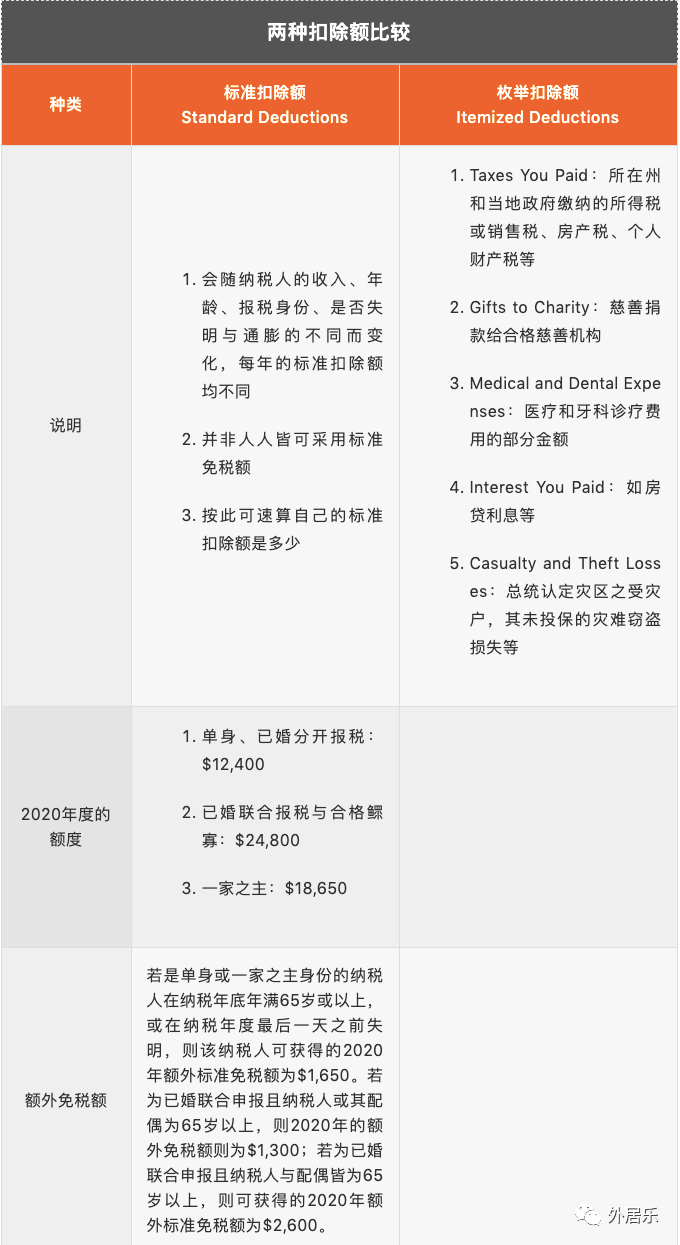

Before diving into the specifics of car loans, it’s essential to understand what it means for an expense to be tax deductible. A tax deduction reduces the amount of income that is subject to taxation, effectively lowering the overall tax liability. In simpler terms, if you can deduct an expense, you can subtract it from your total income when calculating your taxes, which can lead to significant savings.

#### Car Loan Interest: Personal vs. Business Use

The tax treatment of car loan interest largely depends on how the vehicle is used. For personal vehicles, the interest on a car loan is generally **not tax deductible**. This means that if you purchase a car primarily for personal use, you cannot claim the interest paid on your car loan as a deduction on your tax return.

Conversely, if the vehicle is used for business purposes, the rules change. Business owners can often deduct the interest on a car loan if the vehicle is used solely for business. This can include vehicles used for delivering goods, traveling to client meetings, or other business-related activities. In such cases, it’s vital to maintain accurate records of the vehicle's usage to substantiate the deduction.

#### Understanding IRS Guidelines

The IRS has specific guidelines regarding the deductibility of car loan interest. If you’re considering claiming this deduction, it’s important to familiarize yourself with these rules. For instance, if you use your vehicle for both personal and business purposes, you may only deduct the portion of interest that corresponds to the business use of the vehicle. This requires meticulous record-keeping to differentiate between personal and business miles driven.

#### Alternative Deductions for Vehicle Expenses

While the interest on a car loan may not be deductible for personal use, there are alternative deductions available for vehicle expenses. Taxpayers can choose between two methods for deducting vehicle expenses: the standard mileage rate or actual expenses. The standard mileage rate allows you to deduct a set amount per mile driven for business purposes, while the actual expense method involves deducting the actual costs incurred, including fuel, maintenance, and depreciation, in addition to interest on a car loan.

#### Consulting a Tax Professional

Given the complexities of tax laws and the potential for changes in regulations, it’s advisable to consult a tax professional when determining the deductibility of car loan interest. A tax advisor can provide personalized guidance based on your specific circumstances, ensuring you maximize your deductions while remaining compliant with IRS regulations.

#### Conclusion

In summary, the answer to the question, **Is the interest on a car loan tax deductible?**, largely hinges on the use of the vehicle. For personal use, the interest is typically not deductible, while for business use, it may be eligible for deduction under certain conditions. Understanding the nuances of tax deductions related to car loans can help you make informed financial decisions and potentially save money during tax season. Always consider seeking advice from a tax professional to navigate these rules effectively.