Understanding the Key Differences Between Commercial Loan vs Residential Financing

#### Commercial Loan vs ResidentialWhen it comes to financing real estate, understanding the differences between commercial loan vs residential loans is cru……

#### Commercial Loan vs Residential

When it comes to financing real estate, understanding the differences between commercial loan vs residential loans is crucial for investors, business owners, and homebuyers alike. Both types of loans serve distinct purposes and come with their own sets of requirements, terms, and conditions. This article delves into the nuances of commercial loan vs residential financing, helping you make informed decisions whether you're looking to buy a home or invest in commercial property.

#### What is a Commercial Loan?

A commercial loan is a type of financing specifically designed for businesses or commercial properties. These loans are typically used to purchase, refinance, or develop commercial real estate, such as office buildings, retail spaces, warehouses, and multifamily housing units. The terms for commercial loans can vary significantly, often ranging from five to 20 years, and they may require a larger down payment compared to residential loans.

Commercial loans are usually secured by the property itself, meaning that if the borrower defaults, the lender can seize the property to recoup their losses. Additionally, lenders often assess the potential income generated by the property when determining loan amounts and interest rates. This means that the borrower's creditworthiness, business history, and the property's cash flow are critical factors in the approval process.

#### What is a Residential Loan?

On the other hand, a residential loan is intended for individuals looking to purchase or refinance a home. These loans can be used for single-family homes, condominiums, and multi-family properties with up to four units. Residential loans typically have more favorable terms for borrowers, including lower interest rates, smaller down payments, and longer repayment periods, often extending up to 30 years.

The approval process for residential loans focuses primarily on the borrower's credit score, income, and debt-to-income ratio. Lenders are generally more lenient with these loans, as they are backed by government programs like FHA, VA, and USDA loans, which encourage homeownership.

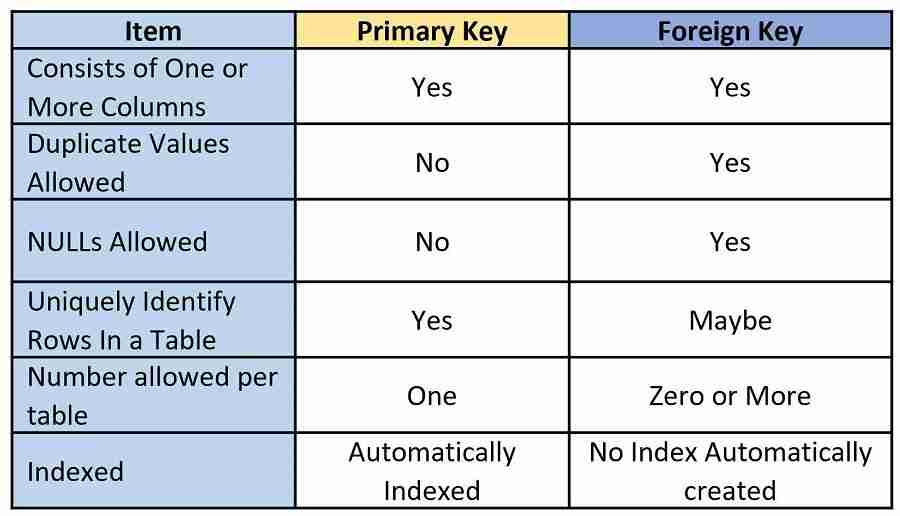

#### Key Differences Between Commercial Loan vs Residential

1. **Purpose**: The primary distinction between commercial loan vs residential loans lies in their intended use. Commercial loans are for business-related real estate, while residential loans are for personal housing.

2. **Loan Terms**: Commercial loans usually have shorter terms and may come with higher interest rates compared to residential loans. The repayment period for commercial loans typically ranges from 5 to 20 years, while residential loans can extend up to 30 years.

3. **Down Payments**: Generally, commercial loans require larger down payments, often 20% or more, while residential loans can sometimes be obtained with as little as 3% down, especially with government-backed programs.

4. **Approval Criteria**: Lenders evaluate commercial loans based on the property's income potential, the borrower's business experience, and creditworthiness. In contrast, residential loans focus more on the individual's credit score and income stability.

5. **Interest Rates**: Interest rates for commercial loans are typically higher than those for residential loans, reflecting the increased risk associated with commercial properties.

#### Conclusion

In summary, understanding the differences between commercial loan vs residential financing is essential for anyone looking to navigate the real estate market. Whether you're a business owner seeking to expand your operations or a homebuyer dreaming of owning a property, knowing the specific features, requirements, and potential pitfalls of each loan type will empower you to make the best financial decisions. Always consult with a financial advisor or mortgage professional to explore your options and find the right loan for your needs.